The Trump Administration’s recent decision to pause federal infrastructure spending has thrown a wrench into the economic growth and modernization of U.S. ports. Specifically, $104,710,550 in Environmental Protection Agency (EPA) grants that were earmarked for Washington State’s ports have been put on hold, jeopardizing critical projects to improve efficiency, reduce pollution, and stimulate job creation.

This move is not just a bureaucratic delay—it’s a strategic misstep with serious economic and national security implications. While the U.S. hesitates, China continues to invest aggressively in maritime infrastructure, shipbuilding, and crane manufacturing, further solidifying its dominance in global trade. If Washington, D.C., does not act swiftly to reinstate these grants, we risk stalling economic growth at home and allowing China to fill the void where the U.S. retreats.

The Economic Power of Port Investment

Investing in port infrastructure isn’t just about improving facilities—it’s an economic multiplier. For every dollar invested, the nation yields $2 to $3 in return. These returns come in the form of job creation, increased trade capacity, and long-term economic growth. Port improvements lead to:

✅ More efficient cargo movement– reducing bottlenecks and increasing throughput.

✅ Job creation– both directly in port operations and indirectly in industries that rely on maritime trade.

✅ Environmental benefits – reducing emissions through electrification and shore power infrastructure.

Pausing $105 million in federal funding to Washington’s ports means delaying these benefits. The grants, part of the Clean Ports Program, were designed to fund shore power deployment, upgrade infrastructure, and create jobs in the private sector. In particular, the $63 million grant to the Port of Anacortes, which was already signed, was set to redevelop an underutilized part of the port, modernizing operations and attracting private investment. Now, that progress is at a standstill.

Public-Private Partnerships Are the Key to Success

Ports operate at the intersection of public and private interests. Government funding alone cannot sustain the investment required for modernization—nor should it. Successful port expansion and efficiency improvements require public-private partnerships (PPPs) to maximize the impact of every dollar spent.

Private companies are eager to invest in modernized port facilities, especially regarding sustainability efforts like shore power, which allows ships to plug into the electrical grid instead of burning diesel fuel while at berth. However, these investments often depend on federal or state funding to build the foundational infrastructure.

Without federal backing, private partners may withdraw or delay their participation, leading to further stagnation and lost economic opportunities. The uncertainty created by freezing these grants is not just delaying progress—it is actively discouraging investment from stakeholders who depend on long-term stability in infrastructure planning.

China’s Maritime Dominance: A Threat to U.S. Competitiveness

While the United States debates whether to continue funding critical port infrastructure, China is not hesitating. The Chinese government heavily subsidizes its maritime sector, investing billions into port expansion, shipbuilding, and crane manufacturing. The result?

- Seven of the top 10 busiest ports in the world are in China.

- China builds nearly 50% of the world’s commercial ships.

- The majority of the world’s port cranes are made in China.

By contrast, the U.S. has only two ports in the top 20 globally. Our shipbuilding industry continues to shrink, and without investment, our ports risk falling even further behind. The Bipartisan Infrastructure Law (BIL) and the Inflation Reduction Act (IRA) were steps in the right direction, but pulling back now only cements China’s advantage.

When the U.S. Retreats, China Fills the Void

The global maritime industry is not just about trade—it’s about national security and strategic influence. Ports are vital supply chain nodes, ensuring the efficient movement of goods and military readiness in times of crisis.

By allowing China to dominate shipbuilding, port infrastructure, and crane manufacturing, the U.S. is effectively ceding control over critical components of the global supply chain. If China controls the world’s ports and the equipment that moves cargo, it also gains leverage over international trade flows. This is a national security risk that cannot be ignored.

The U.S. has already seen how supply chain vulnerabilities can cripple industries, from semiconductor shortages to manufacturing disruptions. Our maritime infrastructure must not be the next weak link.

Washington’s Ports Need Federal Support—Now

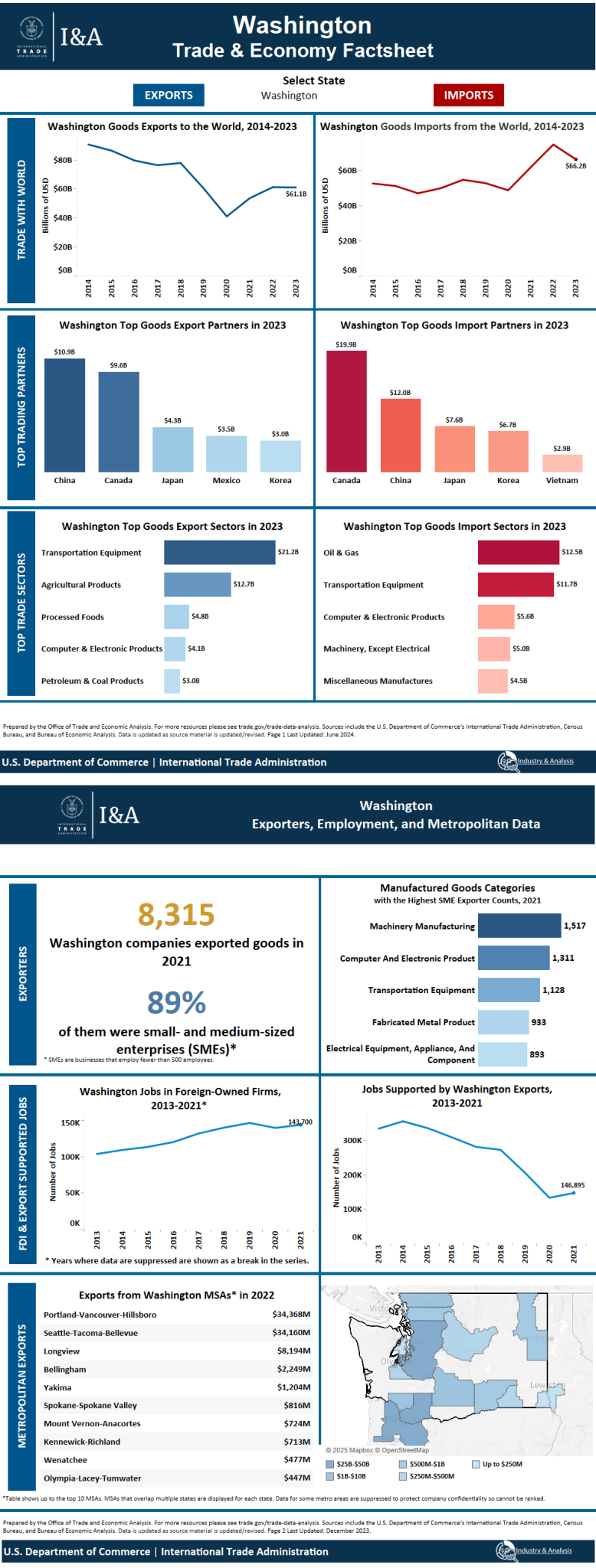

The ports of Washington State play a crucial role in U.S. trade. The Northwest Seaport Alliance (NWSA), which includes the Ports of Seattle and Tacoma, is one of the nation’s largest container gateways. These ports handle goods from Asia, serving as critical economic hubs for not just Washington, but the entire country.

With over $104 million in EPA grants now in limbo, port projects that were set to drive economic growth, improve efficiency, and reduce emissions are now at risk. Specifically:

- The Port of Anacortes was set to receive $63 million for shore power and redevelopment, bringing new jobs and economic opportunities.

- The Port of Bellingham had funding allocated for key infrastructure improvements.

- Other Washington State ports were counting on this funding to modernize their facilities and remain competitive.

The ripple effect of these delays will be felt beyond the maritime sector. Small businesses, logistics companies, and manufacturers all depend on efficient port operations to move goods across the country and internationally.

A Call to Action: Restore Port Funding and Keep America Competitive

The federal government must act now to reinstate these critical port grants. Pausing investment in maritime infrastructure is not just an economic misstep—it’s a failure to compete globally.

✅ Restore the $104+ million in EPA grants to Washington’s ports.

✅ Maintain a commitment to public-private partnerships that drive investment.

✅ Recognize maritime infrastructure as a national security priority.

The time for hesitation is over. Washington’s ports—and ports across the U.S.—cannot afford uncertainty. The investments made through the Bipartisan Infrastructure Law were designed to keep America competitive. Now, as China continues to expand its dominance, we must double down on those investments, not retreat from them.

The bottom line? We won’t quietly let this happen.

It’s time to restore funding and keep our ports—and our economy—moving forward.