I recently had the pleasure of attending the 2024 Virginia Maritime Association Symposium (VMA24), and I can say without hesitation that it was one of the most insightful and inspiring events I’ve been a part of. This symposium brought together an impressive cross-section of industry leaders, policymakers, and innovators—all of whom are dedicated to shaping the future of maritime logistics. With its sharp focus on both Virginia’s maritime sector and the broader national picture, VMA24 provided a unique blend of regional and national perspectives, creating conversations that felt forward-looking, practical, and visionary all at once.

I’ve been in the maritime industry long enough to know that these kinds of events are more than just networking opportunities; they’re catalysts for change. And in that spirit, I’m sharing my thoughts, takeaways, and reflections from VMA24, which I believe could benefit professionals not only in Virginia but also on the West Coast and other regions where maritime plays a crucial role in the local economy.

A World-Class Event with a Clear Vision

VMA24 was a world-class gathering in every sense of the word. The scope of topics discussed, the caliber of speakers, and the quality of the dialogue left no doubt about the symposium’s importance. From discussions on technological innovation to the economic realities facing the industry, every session was a reminder of the essential role maritime plays in the broader economy.

Love or hate his politics, Virginia Governor Glenn Youngkin’s keynote address was particularly memorable. His phrase “unleashing prosperity” struck a chord with everyone in the room. The governor made it clear that maritime isn’t just another sector of the economy—it’s the linchpin holding the entire system together. He spoke our language and knew our pain points. His recognition of maritime as the foundation upon which Virginia’s broader economic strategy rests was both refreshing and critical in today’s economic climate. Virginia is leading the charge in supporting maritime, and it’s something that should be a model for other states, especially on the West Coast where policy and maritime often feel misaligned.

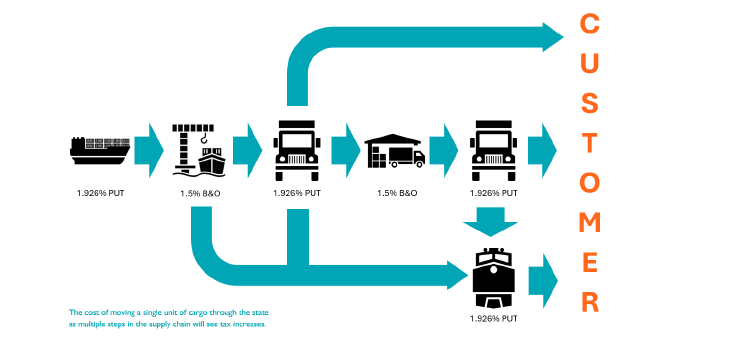

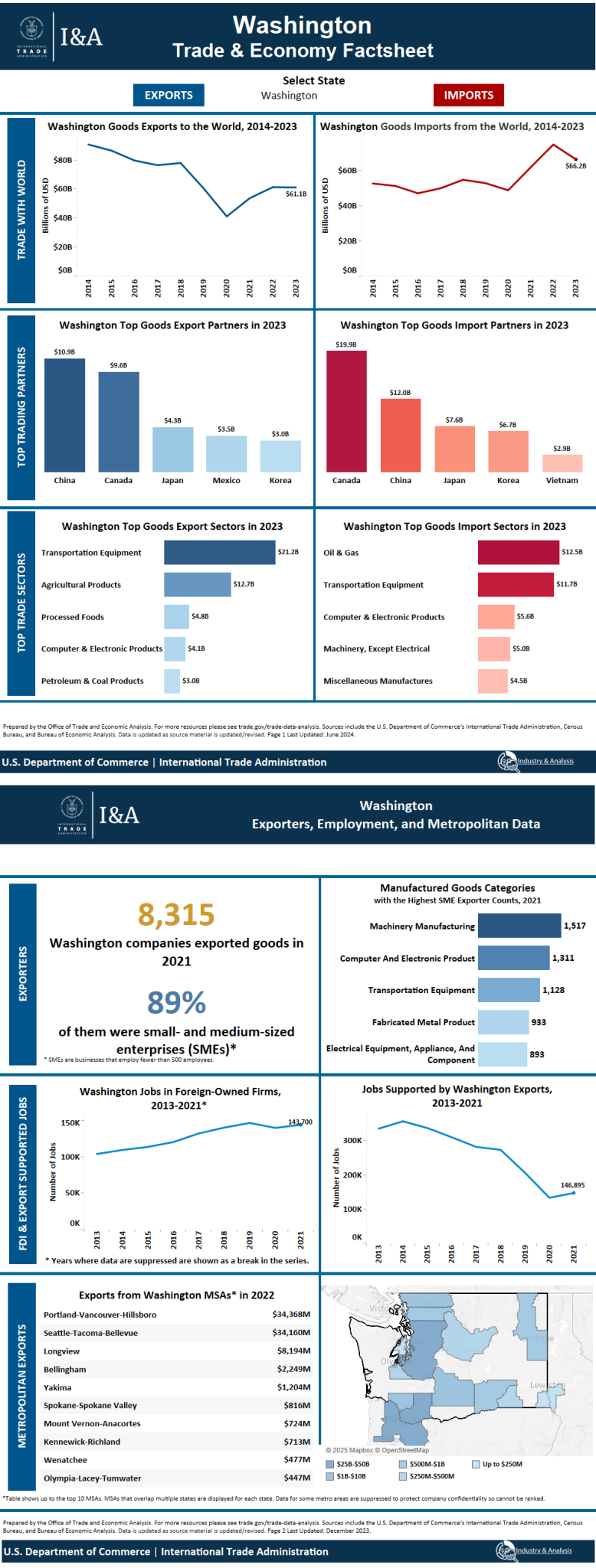

As I listened to the governor’s address, I couldn’t help but compare it to Washington State, where the business climate, ranked #42 in CNBC’s business-friendliness index, presents its own set of challenges. Washington has some of the world’s most critical maritime infrastructure and yet is held back by policies that stifle business growth. Virginia, on the other hand, has consistently been ranked the #1 state for business. The contrast was stark and got me thinking about what we can do to bridge that gap out West.

Virginia as a Business-Friendly Hub: Lessons for Washington State

One of the key takeaways from VMA24 is the way Virginia has positioned itself as a business-friendly hub. The CNBC ranking speaks volumes, but it’s the “why” behind that ranking that caught my attention. Virginia has cultivated a policy environment that reduces regulatory burdens, encourages innovation, and makes it easier for businesses to thrive. When you combine that with its strong maritime infrastructure, you have the perfect conditions for a booming economy.

The maritime sector benefits from this business-friendly climate in ways that go beyond tax incentives or regulatory simplicity. Ports are functioning efficiently because the state has made it a priority. I was struck by the coordinated efforts between government and private enterprises to ensure that Virginia’s ports remain competitive in the global marketplace.

For those of us working on the West Coast, where regulatory challenges often slow down progress, there’s a clear lesson to be learned here. Washington State’s maritime sector is strong, but it’s clear that we need to push harder to align policy with the needs of our ports and maritime businesses. We have the talent, the resources, and the global connections, but we’re being held back by policies that, quite frankly, are outdated in today’s competitive global economy.

The Role of AI and Technology in Maritime: The Future Is Here

Another powerful theme from VMA24 was the role of technology, particularly artificial intelligence (AI), in transforming the maritime industry. This wasn’t just a buzzword conversation; the panelists made it clear that AI is already reshaping logistics and shipping, and its influence will only grow in the years to come.

There were compelling discussions about how AI is being integrated into final-mile logistics and intermodal systems, making freight more efficient and competitive. Ports are increasingly relying on predictive analytics to manage ship traffic, optimize terminal operations, and reduce congestion. AI is giving logistics providers the tools to make smarter, faster decisions—especially as global trade becomes more complex and prone to disruptions.

For example, we’re seeing AI being used to predict port congestion weeks in advance, helping shippers avoid costly delays. And let’s not forget about automation: It’s inevitable. While there are understandable concerns about job displacement, the reality is that automation is going to be essential for ports that want to remain competitive. With labor shortages and the ever-growing demand for faster shipping, there’s no way around it.

As someone who’s worked closely with maritime data and logistics, I found these discussions on AI particularly engaging. We’ve been talking about data-driven decision-making for years, but the level of sophistication we’re now seeing—especially with machine learning models that can optimize everything from ship routes to container loading—is incredible. The integration of AI isn’t a far-off dream; it’s here, and ports on both coasts need to embrace it fully if they want to stay ahead.

Disruptors: Navigating the Uncertainty

Of course, no conversation about maritime in 2024 would be complete without addressing the major disruptors we’re all facing. VMA24 didn’t shy away from tackling the tough issues. From the geopolitical crisis in the Red Sea to the looming ILA (International Longshoremen’s Association) strike in January, there are a lot of unknowns on the horizon.

One of the panelists used the collapse of the Key Bridge in Baltimore as a metaphor for how fragile our infrastructure can be. It was a stark reminder that we often take for granted the critical systems that keep goods flowing. If one key piece of infrastructure fails—be it a bridge, a port, or a terminal—it can bring entire supply chains to a halt. And in today’s interconnected global economy, the ripple effects can be devastating.

The consensus at VMA24 was that resilience is key. We can’t prevent every disruption, but we can build more flexibility into our supply chains. Whether that means investing in alternative routes, stockpiling critical goods, or building out redundancy in infrastructure, the maritime industry needs to be prepared for the unexpected. The West Coast is no stranger to disruptions, with its own set of unique challenges—earthquakes, wildfires, and labor unrest—but we would do well to adopt some of the resilience-building strategies discussed in Virginia.

Sustainability and the Push for Alternative Fuels

Sustainability was another central theme at VMA24, and it’s clear that the maritime industry is at a turning point. The conversation around alternative fuels has moved beyond regulatory compliance and into the realm of competitive advantage. Virginia is positioning itself as a leader in sustainable maritime practices, investing heavily in research and development around alternative fuels. Panelists pointed out that there’s a growing alignment between sustainability and profitability—companies that embrace greener shipping methods are not only reducing their environmental impact but also gaining a competitive edge.

This is a conversation we need to have on the West Coast as well. Washington’s ports have made strides in reducing emissions, but there’s so much more we could be doing. With the global push toward decarbonizing the shipping industry, the Pacific Northwest is in a unique position to lead, but only if we’re willing to invest in the necessary infrastructure and technologies. As someone who’s been in the maritime industry for decades, I can say with certainty that the companies that fail to adapt to this new reality will be left behind.

Standardizing Maritime Data and Information Sharing

Another technical but critical topic that was explored in depth at VMA24 was the need for standardized data across the maritime industry. The Federal Maritime Commission (FMC) has begun establishing data standards that will facilitate better information sharing between ports, carriers, and shippers. This is particularly important in areas like demurrage and detention charges, which continue to cause friction between stakeholders.

Panelists stressed that data silos are one of the biggest obstacles to efficiency in maritime logistics. When information isn’t shared freely or standardized across systems, it creates inefficiencies and increases costs. By harmonizing data, the FMC is laying the groundwork for a more transparent and efficient global supply chain. It’s not glamorous work, but it’s essential for the future of the industry.

For someone like me, who’s spent a good portion of my career dealing with maritime logistics, this is music to my ears. We’ve been talking about the need for better data sharing for years, and it’s exciting to see real progress being made. If ports on the West Coast can adopt these standards and work more collaboratively with their counterparts on the East Coast, we could see significant improvements in efficiency and cost reduction.

Closing Thoughts: Lessons for the West Coast

As I reflect on VMA24, I’m struck by how many of the lessons from Virginia are applicable to other parts of the country, especially the West Coast. The focus on building resilience, embracing technology, fostering business-friendly policies, and investing in sustainability are all things we need to be prioritizing on our side of the country. Virginia’s approach is a model worth studying and, in many ways, emulating.

For those of us in the maritime industry, whether we’re on the East Coast, West Coast, or somewhere in between, the message is clear: The future is full of challenges, but it’s also full of opportunities. The question is, are we willing to adapt, innovate, and invest in the future.